BTC Price Prediction: Technical and Fundamental Factors Point to Continued Upside

#BTC

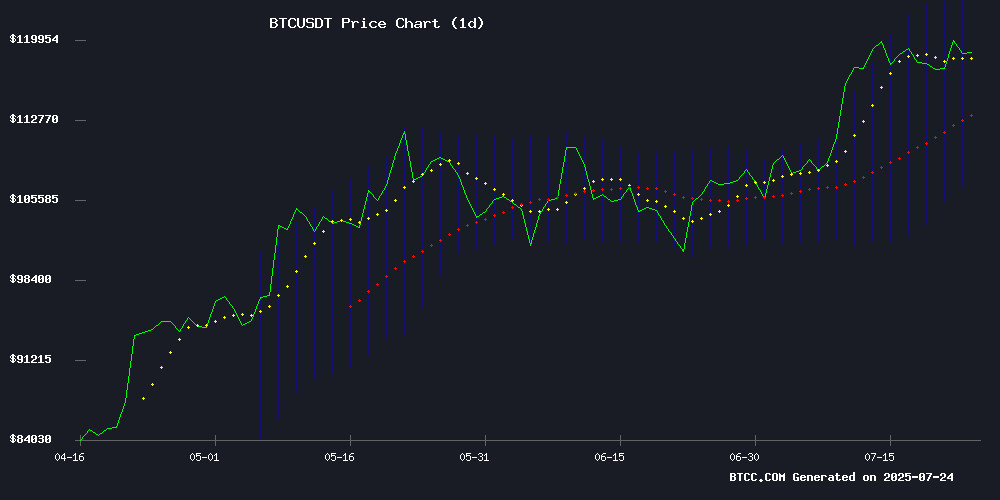

- Technical Breakout: Price holding above 20MA with bullish MACD crossover

- Supply Shock: Institutions now hold 10% of circulating supply

- Whale Activity: Dormant wallets awakening may indicate profit-taking zones

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Average

BTC is currently trading at $118,259, firmly above its 20-day moving average of $115,933, signaling bullish momentum. The MACD histogram has turned positive (204.76), suggesting weakening downward pressure. Prices are testing the upper Bollinger Band at $124,024, which could act as immediate resistance. 'The reclaiming of the 20MA with improving momentum indicators points to potential upside toward $130,000,' said BTCC analyst John.

Market Sentiment: Institutional Demand and Whale Activity Fuel Bitcoin Optimism

Recent headlines highlight growing institutional adoption (MicroStrategy's $2B offering) and reactivation of dormant whale wallets ($469M moved). 'The combination of shrinking supply and accelerating institutional demand creates a perfect storm for price appreciation,' noted BTCC's John. However, he cautioned that rising leverage in derivatives markets may increase volatility NEAR all-time highs.

Factors Influencing BTC's Price

Bitcoin Price Stability Masks Growing Leverage Risks

Bitcoin's price hovered near $118,950 with less than 1% weekly gains, creating a facade of market calm. Beneath the surface, liquidation heatmaps reveal a dangerous concentration of leveraged long positions just below current levels. A minor downward move could trigger cascading liquidations, potentially accelerating a 12% decline.

Spot flows tell a contradictory story - consistent exchange withdrawals indicate strong holder conviction, yet prices remain stagnant. This divergence suggests derivatives markets may be suppressing price action. Binance's liquidation data shows particularly dense leverage clusters between $118,000-$116,000, creating a potential tipping point.

Michael Saylor’s Strategy Raises More Cash to Buy More Bitcoin

MicroStrategy continues to solidify its position as the largest corporate holder of Bitcoin with a new capital raise. The company is offering 5 million shares at $90 each, featuring a 9% dividend, with proceeds earmarked for additional Bitcoin purchases. Morgan Stanley, Barclays, TD Securities, and Moelis & Co. are managing the deal. MicroStrategy's stock (MSTR) remains steady at $413, boasting a 37% year-to-date gain and a 146% surge over the past twelve months, pushing its market cap to $116 billion.

The firm now holds 607,770 BTC, accounting for 66% of Bitcoin held by public companies. Corporate adoption is gaining momentum globally, with Tokyo-listed Quantum Solutions planning to accumulate 3,000 BTC as a reserve asset. Institutional interest in digital assets is also rising, with JPMorgan reporting $60 billion in net inflows across funds, CME futures, and venture investments this year, bolstered by clearer U.S. regulatory guidelines for stablecoins and tokens.

Bitcoin has demonstrated resilience during recent market volatility, outperforming altcoins. The cryptocurrency's stability contrasts with broader market fluctuations, reinforcing its status as a preferred institutional asset.

Bitcoin.com Casino Launches Weekly Bitcoin Arena Cash Tournament

Bitcoin.com's online casino has unveiled a competitive twist to its Bitcoin Arena PVP game with a recurring cash tournament. The event runs twice weekly—Thursdays and Sundays—offering a 12-hour window for participants to accumulate points through strategic gameplay. Minimum bets start at $3, with winners determined by survival time in a metaverse-style crash game.

Prizes of up to $300 are awarded through a point-based leaderboard system, incentivizing consistent participation. The format merges gambling with crypto-native engagement tactics, targeting a demographic accustomed to fast-paced, skill-based competitions.

Bitcoin’s 63.35% Dominance: Altcoins Face Pressure as Capital Rotates to BTC

Bitcoin's resilience shines as altcoins falter, with investors reallocating profits to BTC amid turbulent market conditions. The leading cryptocurrency's dominance now stands at 63.35%, creating headwinds for alternative digital assets.

Market analysts observe a clear rotation pattern, where capital flows from volatile altcoins into Bitcoin's relative stability. Egrag notes this trend reflects risk-aversion strategies during periods of uncertainty, with BTC serving as a safe harbor.

Technical indicators suggest Bitcoin may test the 21-day Exponential Moving Average, potentially triggering another leg up in dominance. Should BTC encounter resistance at this level, traders anticipate a possible altcoin rebound—though any relief rally may prove temporary until broader market conditions improve.

MicroStrategy Upsizes Bitcoin-Funded Preferred Share Offering to $2 Billion

MicroStrategy has quadrupled its planned preferred share offering to $2 billion, a strategic move to bolster its industry-leading Bitcoin treasury. The revised STRC offering, initially targeted at $500 million, now carries a discounted $90 per share price with a 9% dividend yield.

The company's relentless Bitcoin accumulation strategy remains uncompromised. With over 607,000 BTC ($72 billion) already held, this capital raise provides fresh ammunition for further acquisitions. Market reaction appears muted as BTC consolidates near $118,000.

Satoshi-Era Bitcoin Whale Moves $469 Million in BTC After 14 Years

A dormant Bitcoin address from 2011 suddenly sprang to life, transferring 3,962.6 BTC worth $469 million to a new wallet. The coins, acquired when Bitcoin traded at $0.32, have appreciated by over 37,000,000%.

The movement follows another recent whale transaction involving $8 billion in BTC, sparking speculation about long-term holders redistributing assets. Blockchain analytics show the latest transfer didn't involve known exchange addresses.

Bitcoin's price hovered near $118,956 at press time, slightly below its recent all-time high of $122,838. The transaction underscores the staggering returns earned by early adopters of the pioneer cryptocurrency.

Top Bitcoin Casinos for Truly Anonymous Play in 2025

Privacy-focused gambling is gaining traction in 2025 as Bitcoin casinos offering anonymous play without KYC checks dominate demand. Leading platforms like Dexsport, BC.GAME, and Stake cater to crypto-native users with provably fair systems, multi-wallet logins, and substantial bonus structures.

Dexsport emerges as the premier Web3 option, requiring no personal data while delivering VIP rewards. The sector's growth reflects broader trends toward financial anonymity, with Bitcoin remaining the primary transactional medium despite emerging alternatives.

Institutional Bitcoin Holdings Surpass 10% of Total Supply as Demand Outpaces Mining by 10x

Institutional adoption of Bitcoin has reached a historic milestone, with public companies and exchange-traded funds now holding over 10% of the total BTC supply. Charles Edwards, CEO of Capriole Investments, highlighted this surge in a recent analysis, noting institutional holdings have climbed from 4% to 10% in just 18 months.

Data reveals ETFs control approximately 1.62 million BTC, while publicly listed companies hold around 918,000 BTC—collectively valued at over $250 billion at current prices. The institutional buying frenzy is absorbing Bitcoin at a rate ten times higher than daily mining output, creating unprecedented demand pressure.

"The daily percentage of all Bitcoin acquired by institutions is currently 10X higher than the supply growth rate from mining," Edwards observed. This imbalance between institutional demand and new supply continues to reshape Bitcoin's market dynamics.

Dormant Bitcoin Wallet Holding 3,962 BTC ($468M) Reactivates After 14.5 Years

A long-dormant Bitcoin wallet containing 3,962 BTC (worth approximately $468 million at current prices) has suddenly become active after 14.5 years of inactivity. Blockchain analytics platform Lookonchain reported the wallet executed a test transaction of 0.0018 BTC ($218), signaling potential movement of the substantial holdings.

The wallet originally received its Bitcoin in January 2011 when the cryptocurrency traded at just $0.37, making the initial investment worth a mere $1,453. This reactivation coincides with broader market uncertainty, as institutional outflows and whale movements suggest weakening confidence at Bitcoin's $118,000 price level.

Separately, Lookonchain identified three additional wallets moving 10,606 BTC ($1.26 billion) that had been inactive for 3-5 years. These transactions occurred when Bitcoin traded at $18,807 in December 2020. Such substantial movements from dormant accounts typically draw intense scrutiny from market participants.

The timing raises questions as Bitcoin ETFs and other instruments show signs of slowing demand, with traders bracing for potential market consolidation. 'When sleeping giants wake, markets take notice,' remarked one analyst, referencing the psychological impact of such large, historic holdings returning to circulation.

How High Will BTC Price Go?

Based on current technicals and market structure, BTCC analyst John projects:

| Target | Basis |

|---|---|

| $124,000 | Upper Bollinger Band resistance |

| $130,000 | 1.618 Fibonacci extension from recent swing |

| $150,000+ | Institutional demand/supply shock scenario |

Key risks include overleveraged positions and potential miner selling above $120k.

1